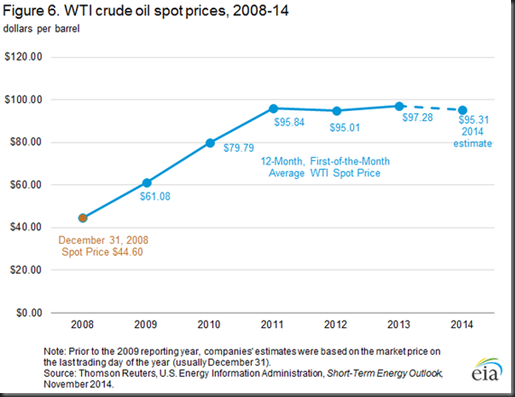

One of the big points that appears to have been largely missed over the last few weeks is that if WTI crude prices stay in the low $60 range, US proved reserves will plummet. Proved reserves over the past few years have been based on a spot price of around $95.

The November 2014 average for WTI was $75 and at the time of writing WTI was sitting at $63.16.

BP explains proved reserves:

“Proved reserves of oil are generally taken to be those quantities that geological and engineering information indicates with reasonable certainty can be recovered in the future from known reservoirs under existing economic and geological conditions.”

The last time oil prices were in the $60 range was in 2009 when reserves were just 30.9 thousand million barrels, 30% lower than the 2013 figure that was last put out by the EIA. In fact the US proved reserves had been sitting around the 30 thousand million barrel mark for sixteen years until the shale boom kicked off and reserves were significantly raised in 2010 and every year after that.

If oil prices stay low the US could be in for a big shock and the mythical “energy independence” will be even further from their grasp. Now of course drilling technology has advanced greatly since 2009 and will lessen the impact. However it is also worth noting that many shale companies have yet to actually make a profit and this price drop could be enough to send investors running which will have further negative impacts.